Getting into real estate is an investment, whether you’re a long-term real estate investor or merely a couple purchasing your first home. However, everyone—from expert to novice investors—is at risk for making crucial mistakes that hurt their pockets and possibly their careers and reputations. Rather than learn from your own mistakes, it helps to learn from the mistakes of others when possible. With that in mind, here are the some of the most common real estate investments that you should avoid:

Not Having a Real Estate Agent—Or Picking the Wrong Agent

Because so much of the home buying and selling process is online, it can create the false impression that you can do everything on your own and save some money in the process. But the reality is, this couldn’t be further from the truth. There’s so much more to buying a house than simply searching for properties online, just as there’s so much more to selling a house than listing pretty pictures. Dealing with legal jargon, contracts, scheduling viewings, marketing properties, and much more, can be strenuous for someone with little to no experience. Furthermore, real estate agents can prove instrumental in price negotiations.

Setting Unrealistic Budgets

It’s not uncommon for early investors to set unrealistic budgets based on their loan prequalification amounts. For instance, just because you’ve been prequalified for $500,000 doesn’t mean you can realistically afford to make mortgage payments on a $500,000 home. Unless absolutely necessary, you should avoid capping your loan pre-qualification amount. Take a holistic look at your current budget and what it would look like if you incorporated your mortgage payments and any other fees, such as homeowner fees and taxes. Always pad your budget to account for unforeseen expenses.

Not Researching the Neighborhood

Neighborhood research is critical for any real estate investment. Thankfully, there are many guides and online resources that offer detailed information about a potential neighborhood. Even the most ideal homes could have underlying issues and depreciating value due to a bad neighborhood. There are a few things you should pay attention to when you’re researching neighborhoods, including historical housing prices, crime rates, local school rankings, transportation, taxes, and natural hazards. Go the extra mile by taking a virtual tour of your neighborhood using Google Street View.

Ignoring Transportation

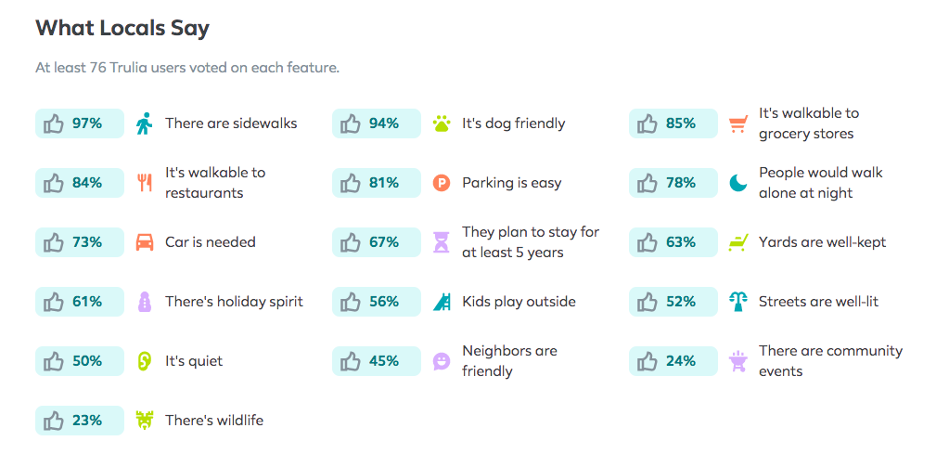

Transportation plays a huge role in how well your investment will do. Temporary and permanent visitors will want to know how to get from Point A to Point B with ease. You should also have a thorough understanding of how to get to commonly visited local spots, like supermarkets, schools, public transportation, shopping areas, and more. A simple Google Maps search will give you a bird’s eye overview of the proximity between the property and key destination. You can check out transportation breakdowns on sites like Trulia. Trulia also displays a local insight into the neighborhood. For instance, here’s how users voted on the Sunset Park neighborhood of Santa Monica:

Overbidding at Auctions

In the excitement of an auction, many people will mistakenly pay more than they need to on a property. If an auction deal seems good at first, you could end up making it a bad deal by overpaying on the final price. Stay strict with your budget, even during a bidding war, and don’t forget that there are pros and cons to buying from an auction. While you may be able to get a great price and close much sooner than usual, you won’t be able to conduct a home inspection and you aren’t offered the same warranty.

Trying to Do Everything Alone

Investing in a property is a big challenge, and you shouldn’t have to go through it alone. You’ll need a solid mortgage broker, real estate agent, and possibly a lawyer on your side. If you plan to make a career out of your investments, then it helps to have a reliable set of connections on your side, including contractors, property managers, photographers, and accountants. Surrounding yourself by many experts can mean the difference between success and a failure.

Putting Too Much Money Into Renovations

There are smart renovations and then there are expensive renovations. New real estate investors might mistakenly spend too much on renovations that won’t translate in the final price tag, and it won’t make a difference to the return on investment. For instance, there’s likely no need to buy granite countertops if you can find a reasonably nice and well-priced alternative. Simple paint jobs and floor updates could make huge differences without breaking the bank.

Leave A Comment