The Tax Cuts and Jobs Act was reformed, signed, and placed into law this past December. Things have changed and the changes affect first time home buyers, home sellers, and real estate professionals. The information down below is what everyone needs to know about the tax reform. Remember, this is not tax advice. It is important to discuss any provisions with your CPA or tax attorney.

Housing Market Impact

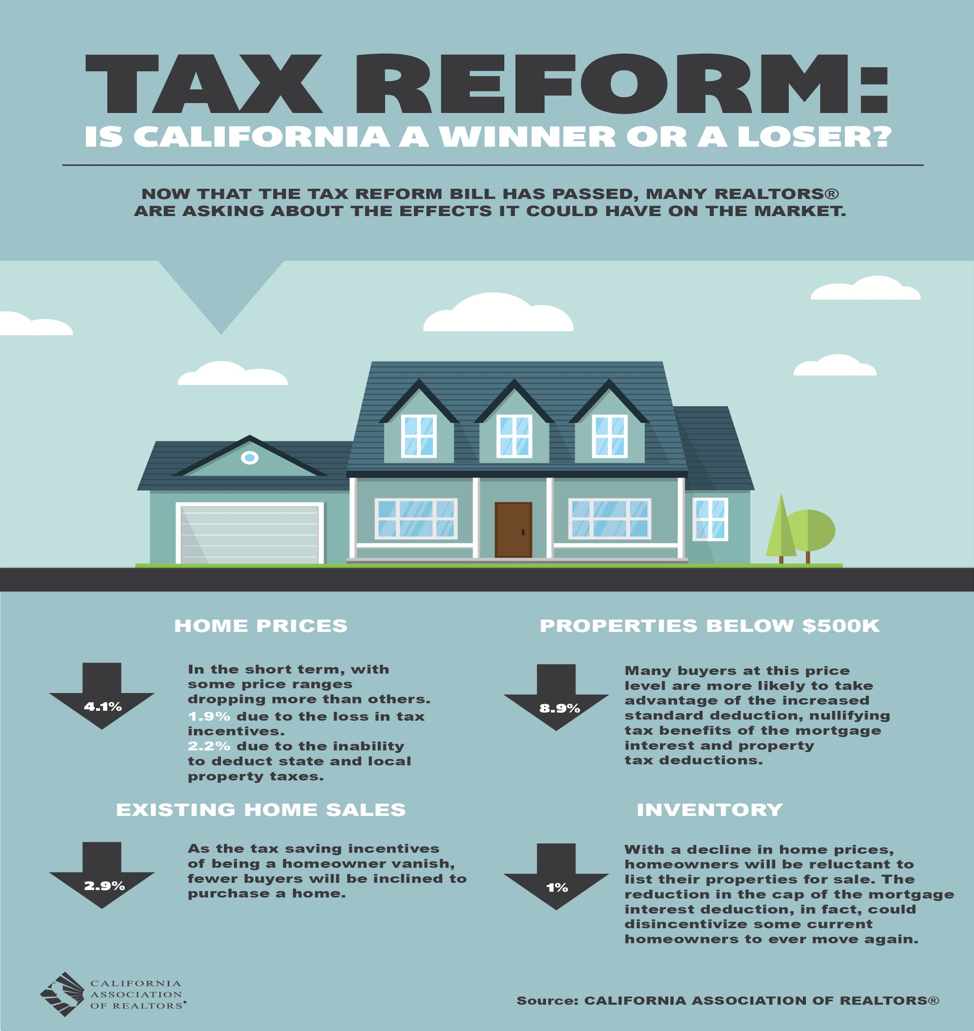

California’s average home price is expected to increase over 3% in 2018. Because of the tax reform, the amount of homes available will decline about 0.3 percent in the active listings. Homeowners my wait longer to downsize or upgrade their home. While the growth of home sales will be slow, California will see some increase.

Vacation & Second Houses

As of this year, you cannot deduct the interest paid on your vacation home loans. While this may seem discouraging, if you rent your vacation home for a part of the year you are entitled to basic write offs that are associated with a business. This means that a portion of your mortgage interest would be included in the operation cost of your vacation or short term rental home.

Local & State Tax

The new bill allows a $10,000 itemized deduction for both local and state taxes. The $10,000 is the same whether you file as a single person or if you are married. While this may seem like an insufficient amount to deduct, the original House and Senate bill wanted to get rid of state and local tax deductions altogether.

Decrease in Mortgage Interest Deduction

If you took out your mortgage loan after December 14, 2017, or you have intentions of purchasing a home in 2018 you will see a decrease of the amount you can deduct in mortgage interest.

The mortgage interest deduction means you can lower your taxable income, and it has been lowered to $750,000 from 1 million dollars. A lot of homes in the US cost less than $750,000. This means the people who lose the most from this deduction are those that live in cities with costly housing markets. New York, Connecticut, and Hawaii will be affected, but California will feel it worse and makes up for over 45%.

Leave A Comment